[ad_1]

Halfpoint Images | Moment | Getty Images

Some retirement savers can still snag an extra tax incentive for 2023. However, most eligible filers don’t claim it, according to the IRS.

The retirement savings contribution credit, or “saver’s credit,” can help low- to moderate-income filers offset part of the funds added to an individual retirement account, 401(k) plan or other workplace plan.

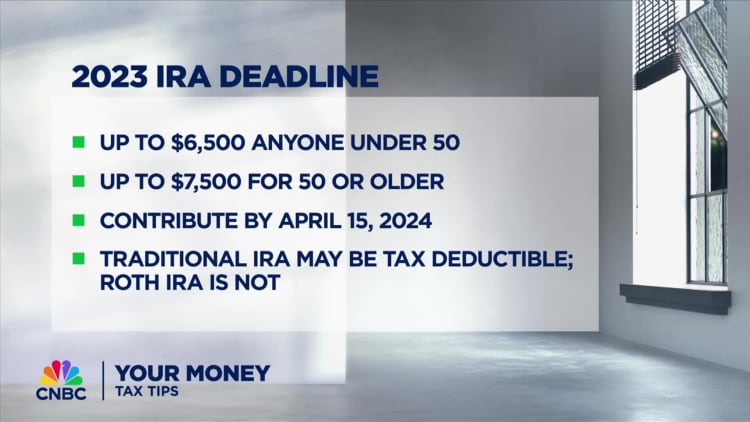

You can still make a 2023 contribution to an IRA before the April 15 filing deadline to “earn a special tax credit,” according to the IRS.

How the saver’s credit works

You can claim as much as 50% of retirement contributions up to $2,000 for single filers or $4,000 for married couples filing jointly for maximum credits of $1,000 or $2,000, respectively.

The tax break offers a dollar-for-dollar reduction of levies owed, which could reduce your tax bill or boost your refund.

But there are income limitations.

For 2023, your adjusted gross income can’t exceed $21,750 for single filers or $43,500 for married couples for the 50% credit. The percentages drop to 20% and 10%, respectively, as earnings increase, with a complete phase-out above $36,500 for individuals or $73,000 for joint filers.

Still, if you qualify for the saver’s credit, you could score multiple tax breaks for a last-minute deposit, including a possible deduction for pre-tax IRA contributions or future tax-free growth for Roth IRA deposits, explained Mark Steber, chief tax information officer at Jackson Hewitt.

Why few filers claim the saver’s credit

Despite the incentive, 5.7% of taxpayers claimed the saver’s credit for tax year 2021, according to IRS estimates. There are a few reasons for the slim percentage, experts say.

Millions of low-earning Americans have little or no tax burden and the saver’s credit isn’t refundable, meaning you can’t get the credit without owing on your taxes.

“If you don’t have much of a tax burden, or any tax liability at all, the value of the credit is extremely limited or potentially zero,” said Emerson Sprick, associate director for the Bipartisan Policy Center’s Economic Policy Program.

If you don’t have much of a tax burden, or any tax liability at all, the value of the credit is extremely limited or potentially zero.

Emerson Sprick

Associate director for the Bipartisan Policy Center’s Economic Policy Program

Plus, “most people don’t know this credit exists,” Sprick said.

Indeed, fewer than half of U.S. workers aren’t aware of the saver’s credit, according to a recent survey from the Transamerica Center for Retirement Studies.

However, even if someone has a tax liability and knows about the credit, they need to have enough money to save, Sprick said.

In 2027, the saver’s credit is slated to convert to a saver’s match from the federal government, which could address some of the current restrictions. But retirement savings barriers remain, experts say.

“The most effective way to bring people into the retirement savings ecosystem is through employer-sponsored retirement plans” with automatic contributions, Sprick said.

While access has improved, many Americans still don’t have a workplace retirement plan.

[ad_2]

Source link