[ad_1]

Artistgndphotography | E+ | Getty Images

With tax season in full swing, the IRS has issued more than 2.6 million refunds worth about $3.65 billion, as of February 2, the agency reported on Friday.

So far, the average refund is $1,395, compared to $1,963 one year ago, which is roughly 29% smaller.

However, since the 2024 tax season kicked off on Jan. 29, the average refund is only based on five days, compared to 12 days from one year ago, the IRS noted, saying the early statistics suggest a “strong start to filing season 2024.”

“It really is very preliminary data,” said Mark Steber, chief tax information officer at Jackson Hewitt. “I caution anyone on reading too much into an entire year, or a tax season of three and a half months, on five days worth of data.”

Last year, the average refund for the 2023 filing season was $3,167, as of December 29, according to the IRS.

A lot of people who typically file early — such as earned income tax recipients and child tax credit recipients — still haven’t filed, Steber said.

By law, filers claiming the refundable portion of the child tax credit or earned income tax credit won’t get refunds until Feb. 27 at the earliest, the IRS says.

Why some tax refunds could be bigger

Typically, you can expect a refund when you overpay taxes throughout the year. Many workers automatically send money via paycheck withholdings. By comparison, you may owe money if you didn’t pay enough last year.

“We’re still seeing bigger refunds coming,” Steber said, partially due to higher inflation.

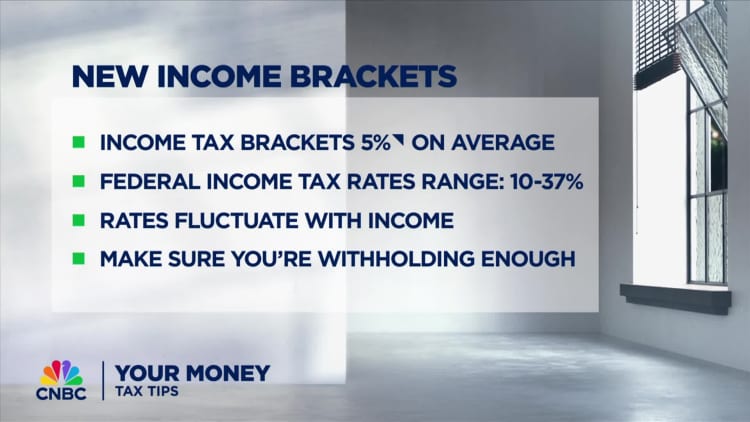

If your income didn’t keep pace with inflation in 2023, you could see a larger refund this season due to IRS inflation adjustments, he said, such as higher federal tax brackets, the standard deduction and more.

“We fully expect refunds to be healthy,” Steber added.

‘Don’t wait on Congress’ to file

There’s pending tax legislation in Congress that could provide a retroactive boost for the child tax credit for 2023, which could increase refunds for certain eligible filers.

But if taxpayers are prepared to file, they shouldn’t wait, according to the IRS.

“We urge and encourage taxpayers to file when they’re ready,” IRS Commissioner Danny Werfel told reporters in January during a press call. “Don’t wait on Congress.”

However, nearly half of taxpayers don’t plan to file until March or later, citing complexity and stress as the top reasons for delaying, according to a January survey from IPX1031, an investment property exchange service.

[ad_2]

Source link